US President Donald Trump hosted a dinner for companies pledging funds to build a new ballroom in the White House, with attendees reportedly including Gemini co-founders Cameron and Tyler Winklevoss, and executives from Coinbase and Ripple. According to a Wednesday Wall Street Journal report, among the donors and attendees of the dinner at the White House were the Winklevosses and representatives from Coinbase Global and Ripple Labs. The dinner was reported to be aimed at funding for the White House ballroom proposed by Trump in July, which was estimated to…

Tag: Report

Nobel Peace Prize Bets on Polymarket Under Scrutiny: Report

Norwegian officials have reportedly launched an investigation into prediction platforms’ bets on 2025 Nobel Peace Prize winner María Corina Machado as potential espionage. According to a Bloomberg report on Monday, the Norwegian Nobel Institute, the entity that assists the Nobel Committee in selecting the peace prize recipient, began investigating reports that bets on the prediction platform Polymarket surged in the hours before the announcement of Machado as the winner. Officials are reportedly still in the process of investigating whether someone “managed to steal information and made a lot of money…

Securitize Eyes $1B SPAC Deal With Cantor Fitzgerald: Report

Securitize, the tokenization platform behind several major blockchain-based investment products, including BlackRock’s tokenized US Treasury fund, is reportedly in talks with Cantor Fitzgerald to go public via a Special Purpose Acquisition Company (SPAC). Bloomberg reported Friday, citing anonymous sources, that Securitize is in discussions to merge with Cantor Equity Partners II Inc., a blank-check firm backed by Cantor Fitzgerald. The deal could value Securitize at more than $1 billion, the report said. Securitize did not immediately respond to Cointelegraph’s request for comment. Source: Bloomberg A SPAC is a publicly traded…

Tether to Propose Board Candidates for Juventus Football Club: Report

Stablecoin issuer Tether will reportedly pitch its own list of board candidates and “governance changes” for Juventus, a football club based in Italy in which the company has a 10.7% stake. According to a Monday Reuters report, Tether’s suggestions for the football club’s board will come ahead of a Nov. 7 shareholder meeting, and it will also contribute about $129 million as part of a capital increase in Juventus. The stablecoin issuer initially invested in Juventus in February, increasing its stake to more than 10% in April as part of…

Walmart-Owned Bank App OnePay to Add Crypto Support: Report

OnePay — a banking app majority-owned by Walmart — will soon roll out crypto support, according to CNBC. According to a Friday CNBC report citing anonymous sources, OnePay will soon offer cryptocurrency trading and custody to its users. The app is expected to support Bitcoin (BTC) and Ether (ETH) later this year. OnePay has positioned itself as a US version of a “superapp,” modeled after China’s WeChat. The platform already offers banking services including high-yield savings accounts, credit and debit cards, loans and wireless plans. WeChat is China’s all-in-one “superapp,”…

SoftBank, ARK Eye Stake in Massive Tether Fundraise: Report

At least two high-profile investment companies are reportedly vying to back stablecoin issuer Tether as it looks to sell roughly 3% of its equity — a move that underscores pent-up investor demand for one of the world’s most profitable companies. According to Bloomberg, venture capital giants SoftBank Group and ARK Investment Management are among potential investors considering a combined investment of up to $20 billion in Tether. As Cointelegraph reported this week, if successful, the funding round could value the company at up to $500 billion, placing it among the…

Vanguard explores crypto ETF access for US brokerage clients: Report

Key Takeaways Vanguard is considering allowing US brokerage clients to access crypto ETFs, a change from their previous restrictive policy. This move comes as other major firms, like Morgan Stanley and E*Trade, open access to direct crypto trading for clients. Share this article Vanguard, the major asset management firm, is exploring allowing its US brokerage clients to access crypto ETFs, according to Crypto In America. The potential move would mark a shift for Vanguard, which previously restricted client access to cryptocurrency investment products. Other major firms have been expanding crypto…

BlackRock and major firms report $76M outflows in Ethereum ETFs

Key Takeaways Spot Ethereum ETFs recorded $76 million in outflows, reflecting continued volatility in investor interest. Major asset managers, including BlackRock, Fidelity, and Bitwise, reported significant redemptions from their Ethereum ETF products. Share this article Spot Ethereum ETFs recorded $76 million in outflows on Monday, with major asset managers BlackRock and Fidelity among the firms reporting investor redemptions from their exchange-traded funds. The outflows continue a pattern of volatility seen in September 2025, with ETH-tracking funds experiencing fluctuating investor interest. Fidelity and Bitwise drove much of the redemption activity, while…

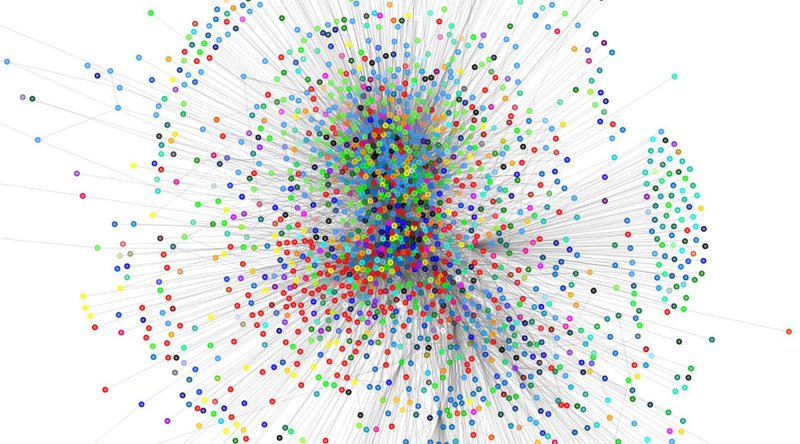

Progress Report: Lightning Network Surpasses $1M BTC Capacity, 4,000 Nodes

The Lightning Network continues to post steady growth. According to data from 1ML, the network is now supported by roughly 4,070 nodes, which house just over 12,500 payment channels, an average of 10.91 channels per node (at time of publication). Most of this growth has come in the later half of 2018, as the average age of each node is just 137 days old. With infrastructural growth, the network is also seeing an uptick in liquidity. At the time of writing, the network’s collective capacity now stands at 223.65 BTC, which, at…

Crypto Exchange Gate.io Removes StatCounter Service Following Report of Security Breach

Crypto exchange Gate.io has removed web analytics tool StatCounter from their website following a breach report by cybersecurity firm ESET, according to an official blog post published today, Nov. 7. The company has reported that they immediately removed StatCounter’s traffic stats service after receiving a security notice by ESET about suspicious behavior. Gate.io claimed they subsequently scanned the website with 56 antivirus products, and “no one reported any suspicious behavior at that time.” However, the firm still changed its traffic tracker, also reporting that “users’ funds are safe.” On Nov.…