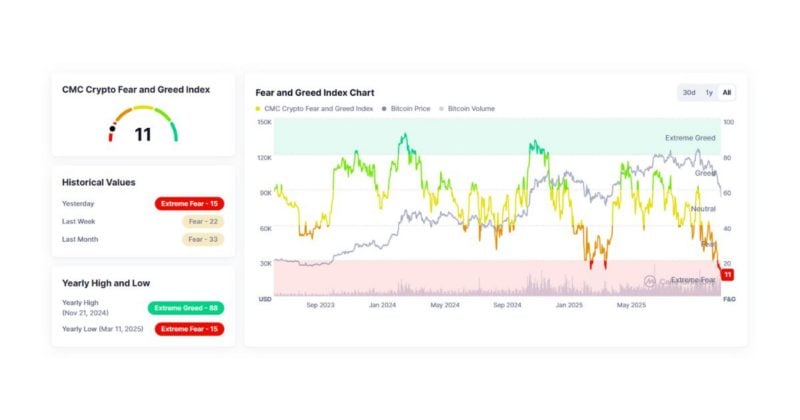

Key Takeaways Market fear has hit an unprecedented level, according to the CMC index. The index measures market sentiment by analyzing volatility, trading activity, and momentum in the crypto sector. Share this article Today, CoinMarketCap’s Crypto Fear and Greed Index fell to 11, its lowest reading on record and the deepest extreme-fear level the indicator has ever captured. The index, a market sentiment tool from CoinMarketCap that evaluates factors such as volatility, trading activity, and momentum, assesses investor emotions ranging from fear to greed in crypto markets. Recent market discussions…

Tag: Hits

Coinbase premium gap hits -$90, signaling market power shift

Key Takeaways The Coinbase premium gap has fallen to -$90, indicating unexpected market behavior. A negative premium gap suggests selling pressure and less demand from institutional investors on Coinbase. Share this article Coinbase’s premium gap has dropped to -$90, reflecting a significant shift in Bitcoin market dynamics as institutional demand weakens. A negative Coinbase Premium Gap indicates cautious investor behavior and changing demand patterns in the Bitcoin market. The metric measures the price difference between Coinbase Pro and other major exchanges, with negative values suggesting stronger selling pressure on the…

Cloudflare Outage Hits Multiple Crypto Websites, Social Media Channels

Cloudflare, the company responsible for providing network services to websites and platforms across the internet, reported disruptions, which removed access to the front end of many cryptocurrency websites and communications through social media. In a Tuesday update to its system status, Cloudflare said that it had implemented a fix after reporting an “internal service degradation” at 11:48 am UTC. “[W]e believe the incident is now resolved,” said Cloudlfare in an update on its status. “We are continuing to monitor for errors to ensure all services are back to normal.” Source:…

Bitcoin OG Owen Gunden moves $372M in BTC, first batch hits Kraken

Key Takeaways Owen Gunden transferred 500 BTC worth about $52 million to Kraken. The move continues Gunden’s pattern of selling activity as an early Bitcoin adopter. Share this article Early Bitcoin investor Owen Gunden moved around 3,600 Bitcoin, valued at approximately $372 million, on Friday, according to data tracked by Lookonchain. Of this amount, 500 BTC worth nearly $52 million was already deposited into Kraken, with the remaining 3,100 BTC expected to land on the exchange in the near future. The OG Bitcoin whale’s transfers occurred amid recent market volatility,…

Bitcoin Coinbase Premium Hits 7-month Low: Is $95K Next?

Key takeaways: Bitcoin dropped below $100,000 and could retest its yearly open at $93,500 as its momentum weakens. The Coinbase Premium hit a seven-month low, reflecting strong US spot Bitcoin selling pressure. Short-term holders are accumulating BTC, while long-term holders continue taking profits. Bitcoin’s (BTC) recent weakness extended into Friday’s trading session, with BTC once again slipping below the $100,000 mark. The cryptocurrency could potentially retest its previous low of $98,200, a level formed on June 23. On Nov. 6, the Bitcoin Coinbase Premium Index, a metric that tracks the…

Ripple Hits $40B Valuation with Citadel, Fortress Backing

Blockchain payments company Ripple has been valued at $40 billion following new equity investments from Citadel Securities and Fortress Investment Group, underscoring the growing appeal of blockchain technology among mainstream financial institutions. According to a Financial Times report on Wednesday, Ripple raised $500 million from several investors in its latest funding round, which cemented the lofty valuation. The deal signals a broader shift as established Wall Street firms move to gain exposure to the digital payments and blockchain sector despite ongoing market pressures. Other investors included hedge fund Brevan Howard…

Bitcoin Accumulation Hits Records in ‘Normal’ BTC Price Dip

Key points: Bitcoin accumulator addresses grab 375,000 BTC in a month in a new record. Accumulators added 50,000 BTC as price slipped under $100,000 for the first time in months. The drawdown from October’s all-time high remains within “normal parameters.” Bitcoin (BTC) accumulation is hitting record levels as a trader plays down the sub-$100,000 BTC price dip. Data from onchain analytics platform CryptoQuant published on X Wednesday by contributor Darkfost shows buyers adding 375,000 BTC in just one month. Bitcoin dip-buyers hit 375,000 BTC monthly record Bitcoin hodlers may be…

Tron Daily Active Address Count Hits All-Time High

Blockchain data suggests more people are transacting on the Tron network than ever before amid strong retail adoption and the rising popularity of the high-speed, low-cost chain. The number of daily Tron daily active addresses rose to a record 5.7 million on Tuesday — beating the previous record of 5.4 million set the day before — while the more than 12.6 million transactions clocked on Tuesday were the highest daily tally since June 12, 2023, TRONSCAN data shows. “No headlines. No hype. Just raw throughput. That’s top-tier activity with zero…

Bitcoin Loses $113,000 as S&P 500 Hits New Highs on FOMC Day

Key points: Bitcoin struggles to return to its range highs after its latest sell-off. BTC price targets for the new “volatile retest” focus on $111,000 and a $114,500 weekly close. Fed rate-cut anticipation sees new record highs for the S&P 500. Bitcoin (BTC) stayed under pressure at Wednesday’s Wall Street open as US stocks hit record highs. BTC/USD one-hour chart. Source: Cointelegraph/TradingView Bitcoin stages “volatile retest” into FOMC Data from Cointelegraph Markets Pro and TradingView showed BTC price action clinging to $113,000. BTC/USD nursed losses from a sell-off that began…

S&P Global Hits Strategy With B- Credit Rating

S&P Global Ratings has given Michael Saylor’s Strategy a “B-” credit rating, placing it in the speculative, non-investment-grade territory — often referred to as a “junk bond” — although it said the Bitcoin treasury company’s outlook remains stable. “We view Strategy’s high bitcoin concentration, narrow business focus, weak risk-adjusted capitalization, and low US dollar liquidity as weaknesses,” the credit rating platform said in a review of Strategy on Monday. Strategy has accumulated its 640,808 BTC treasury mainly via equity and debt financing. The stable outlook assumes the company will prudently…