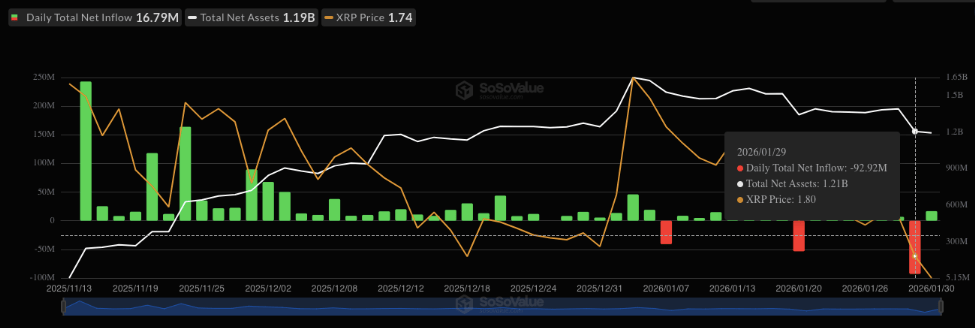

Despite a major outflow just a day earlier, Spot XRP ETFs have defied bearish sentiment, setting record trading volumes and attracting fresh inflows. This resilience and surge in investor demand is particularly surprising given the recent crash in the XRP price and the overall downturn in the broader crypto market. Related Reading XRP ETFs Defy Trends And Hit Record Volume XRP is making headlines after its ETF experienced fresh inflows following a significant outflow. According to data from SoSoValue, XRP ETFs saw a record $92.9 million drop on January 29,…

Tag: ETFs

Bitcoin And Ether ETFs Post $1.82B Outflows Across Trading Week

Investors pulled around $1.82 billion from US-based spot Bitcoin and Ether exchange-traded funds (ETFs) over the past five trading days, as market sentiment continued to weaken after the precious metals rally. Between Monday and Friday, US-based spot Bitcoin (BTC) ETFs lost $1.49 billion, while spot Ether (ETH) ETFs saw $327.10 million in net outflows, according to Farside. The outflows come as the spot price of both cryptocurrencies continued to decline, despite recent signs of a recovery. Over the past seven days, Bitcoin and Ether have fallen 6.55% and 8.99% respectively,…

Crypto ETFs Shed Over $1B In Daily Outflows As Market Slides

Cryptocurrency investment products faced heavy outflows on Thursday as the total crypto market capitalization fell about 6%. Bitcoin (BTC) and Ether (ETH) funds recorded nearly $1 billion in outflows, among the largest of the year so far, according to SoSoValue. Spot Bitcoin exchange-traded funds (ETFs) led the sell-off, shedding $817.9 million, exceeding last Wednesday’s $708.7 million outflows and marking the largest daily outflow since November 2025. The crypto decline coincided with broader market weakness, including a 4% drop in gold after a recent surge above $5,300, according to data from…

Japan May Permit Crypto ETFs Under Proposed Regulatory Changes

Japan’s financial regulator is weighing potential rule changes that could pave the way for cryptocurrency exchange-traded funds (ETFs), with local media reporting that 2028 is being discussed as an early target. According to a report by Nikkei, citing people familiar with the matter, Japan’s Financial Services Agency plans to amend its regulatory framework to allow crypto to be included as eligible ETF assets alongside stronger investor-protection mechanisms. Major financial groups, including Nomura Holdings and SBI Holdings, are among the first companies expected to develop crypto-linked ETF products, Nikkei reported. If…

Bitcoin ETFs Lose $1.72B in Five-Day Outflow Streak

US-based spot Bitcoin exchange-traded funds (ETFs) have extended their outflow streak to five days as crypto market sentiment continues to wane. Spot Bitcoin (BTC) ETFs posted $103.5 million in net outflows on Friday, continuing an outflow streak that began the previous Friday. Over the five days, including the four-day trading week in the US shortened by Martin Luther King Jr. Day on Monday, total outflows reached approximately $1.72 billion, according to Farside data. The spot price of Bitcoin is $89,160 at the time of publication, having not been above the…

Ondo Finance launches tokenized US stocks and ETFs on Solana

The integration of tokenized stocks on Solana could revolutionize blockchain finance, enhancing accessibility and liquidity for global investors. Ondo Finance has launched Ondo Global Markets on Solana, introducing hundreds of tokenized stocks and ETFs to the blockchain’s 3.2 million daily users, according to a Wednesday announcement. Built to bring traditional public securities onto the blockchain, Ondo Global Markets enables investors to buy, sell, and trade over 200 tokenized US stocks and ETFs, with crypto rails enabling fast, secure, and scalable transactions. After debuting on Ethereum and expanding to BNB Chain,…

Spot Bitcoin and Ether ETFs See Heavy Outflows Amid Macro Uncertainty

Spot Bitcoin and Ether exchange-traded funds (ETFs) faced heavy outflows on Tuesday, as macroeconomic and geopolitical uncertainty continued to weigh on markets. Spot Bitcoin (BTC) ETFs recorded $483.4 million in daily outflows, with the Grayscale Bitcoin Trust ETF (GBTC) leading the selling at $160.8 million, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) at $152 million, according to data from SoSoValue. Spot Ether (ETH) ETFs posted $230 million in net outflows, ending a five-day streak of positive flows, with BlackRock’s ETHA seeing $92.3 million exit. Spot XRP (XRP) ETFs also…

Bitpanda Adds 10,000 Stocks and ETFs to All-In-One Platform

Bitpanda is expanding beyond digital assets as it moves to offer stocks and exchange-traded funds (ETFs) on the same platform, advancing its push toward what it calls a universal exchange model. Beginning Jan. 29, the Vienna-based crypto exchange will open access to about 10,000 stocks and ETFs, according to a Tuesday announcement shared with Cointelegraph. Bitpanda said the move will allow users to trade traditional financial products alongside cryptocurrencies within a single app. The company said trades in stocks and ETFs will be priced at a flat fee of 1…

Banks, Stablecoins and ETFs Collide in Crypto’s Next Phase

A sharp fault line is forming across the digital asset industry between crypto products that increasingly resemble regulated financial institutions and a traditional banking sector warning that some of those innovations may be going too far. That tension is on full display this week. JPMorgan is cautioning that yield-bearing stablecoins risk recreating core banking functions without the safeguards built up over decades of regulation. At the same time, Wall Street’s engagement with crypto continues to deepen, with Morgan Stanley’s exchange-traded fund (ETF) filings signaling what analysts describe as the next…

Crypto Market Slide Hits ARK ETFs as Coinbase, Roblox Weigh on Returns

A pullback in crypto markets during the fourth quarter of 2025 weighed on several of Cathie Wood’s ARK exchange-traded funds (ETFs), revealing that the firm’s flagship funds are sensitive to digital asset performance. According to ARK’s quarterly report released Wednesday, weakness in crypto-linked equities, led by Coinbase, emerged as a key drag on performance. The exchange was among the largest detractors across multiple ARK funds, including the ARK Next Generation Internet ETF (ARKW), ARK Blockchain & Fintech Innovation ETF (ARKF) and the ARK Innovation ETF (ARKK). Coinbase’s shares declined more…