Key takeaways: Low BTC and ETH leverage appetite contrasts with strong stock markets, highlighting fragile sentiment despite improving liquidity expectations. While economic uncertainty persists, anticipated monetary easing reduces downside risk for cryptocurrencies, favoring a potential bullish momentum. Bitcoin (BTC) and Ether (ETH) gained momentum on Wednesday, rising to their highest levels in two weeks as investors await a more expansionist monetary policy. Weak economic indicators boosted expectations of fresh stimulus measures, increasing demand for scarce assets. The S&P 500 index and gold also reacted positively as investors anticipated higher liquidity…

Tag: btc

BTC Shows Strongest Buy-Side Revival of Q4 With a 6% Rise

Bitcoin (BTC) gained 5.81% on Tuesday, its biggest daily return since May 8. As the rally unfolded, a bullish engulfing pattern formed, marking the first significant structural shift on the daily chart in the fourth quarter. Traders now wonder if there is an increased chance for a sustained recovery over the coming day. Bitcoin one-day chart. Source: Cointelegraph/TradingView Key takeaways: Bitcoin printed a bullish engulfing candle with its strongest daily gain since May, signaling early trend expansion. A daily close above $96,000 is required for full bullish confirmation. Buy-side trading…

Bitcoin Analyst Sees 96% Positive Performance Odds for BTC Price in 2026

Bitcoin (BTC) has been in a downtrend since early October, with the price dropping below its network value, suggesting a possible recovery in 2026. Key takeaways: Bitcoin price dropped below its fair value, a setup that has historically preceded positive one-year returns. Strengthening network activity suggests robust adoption beyond speculation. Bitcoin spot CVD flipped positive, signalling renewed buy-side activity. Bitcoin’s network value hints at BTC price recovery Bitcoin price is trading 31.4% below its $126,000 all-time high reached on Oct. 6, according to data from Cointelegraph Markets Pro and TradingView. …

BTC Reversion Play Stops Price at $93K: What’s Next

Bitcoin (BTC) attempted to close above a key resistance zone last week after briefly spiking to roughly $93,300. However, BTC failed to stop a mean-reversion trend, with the price dropping below $85,000 on Monday. Bitcoin four-hour chart. Source: Cointelegraph/TradingView Key takeaways: Bitcoin’s inability to close above $93,000 invalidated the confirmation of a bullish trend reversal. Without fresh spot demand, Bitcoin could range between $80,600 and $96,000 until one of those levels is retested. Lack of spot buyers flattens bullish sentiment Thin spot liquidity and weak order-book depth are the major…

BTC price analysis: Bitcoin could crash another 50%

Bitcoin’s first monthly MACD rollover this cycle, alongside onchain data, raised the odds of a deeper pullback, as BTC price forecasts now include the mid-$60,000s. Source link

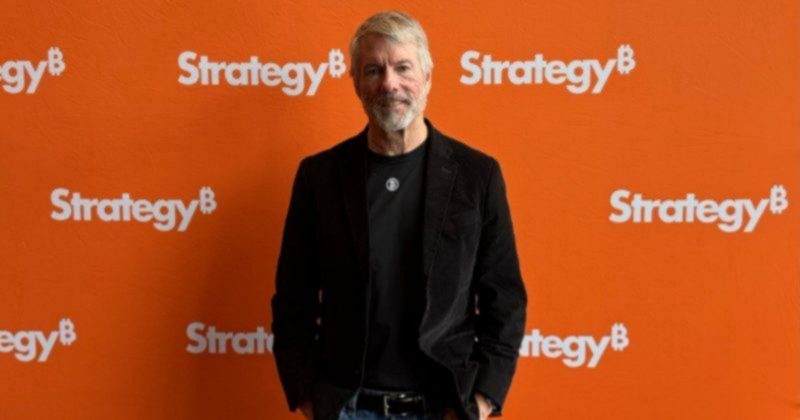

Strategy Builds $1.44B Reserve and Expands BTC Stash To 650K

Michael Saylor’s Strategy, the world’s largest public Bitcoin holder, is creating a $1.44 billion US dollar reserve to support dividend payments on its preferred stock and interest on its outstanding debt. Strategy on Monday announced the establishment of a US dollar reserve funded through proceeds from the sale of Class A common stock under its at-the-market offering program. “Strategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of its dividends, and Strategy intends to strengthen the USD Reserve over time,…

Strategy acquires 130 Bitcoin at $90K, holdings reach 650,000 BTC

Key Takeaways Strategy, led by Michael Saylor, bought 130 Bitcoin for $11.7 million in late November 2025 The average purchase price was around $90,000 per Bitcoin. Share this article Strategy, the business intelligence firm led by Michael Saylor, acquired 130 Bitcoin for $11.7 million in late November. The purchase price averaged around $90,000 per Bitcoin. Strategy now holds 650,000 Bitcoin, valued at approximately $56 billion at current market prices. The acquisition continues Strategy’s pattern of adding Bitcoin to its corporate treasury throughout 2025. The company has maintained its Bitcoin accumulation…

Bitcoin Derivatives and ETF Flows Signal Caution: Will BTC break $91K?

Bitcoin (BTC) failed to reclaim $93,000 despite positive momentum in the US stock market and rising gold prices. With the S&P 500 trading just 1% below its all-time high, traders are evaluating what could spark sustainable bullish momentum for Bitcoin. Key takeaways: Demand for BTC put (sell) options and stagnant ETF inflows kept momentum capped despite easing macroeconomic conditions. AI-driven tech relief has cut market stress, but BTC strength relies on holding $90k as investors bet on liquidity support amid softer job market data. Fed target rate expectations for Dec.…

BTC whale switches from $91M short to 3x long position

Key Takeaways A prominent BTC whale has switched from holding a $91 million short position to a 3x long position. This major shift could signal increasing bullish sentiment among large Bitcoin holders. Share this article A crypto whale who previously opened a short position of 1,000 BTC valued at around $91 million has closed the bet at a $1.6 million loss and switched to a 3x leveraged long position with a liquidation price near $59,112, according to data tracked by Lookonchain. The shift comes as Bitcoin continues to hold above…

Bitcoin Analysts Say This Must Happen for BTC Price to Break $92K

Bitcoin’s (BTC) relief rally to $91,000 appears to be cooling off, but analysts believe the short-term trend for BTC “remains up.” Key takeaways: Bitcoin must take out immediate resistance between $92,000 and $95,000 next. Spot volume and trading activity must recover to lift BTC back into six figures. Bitcoin bulls must reclaim the yearly open first The BTC/USD pair has been trading with a tight range between $90,300 and $92,000 since recovering from multimonth lows of $80,000, per data from Cointelegraph Markets Pro and TradingView. Private wealth manager Swissblock said…