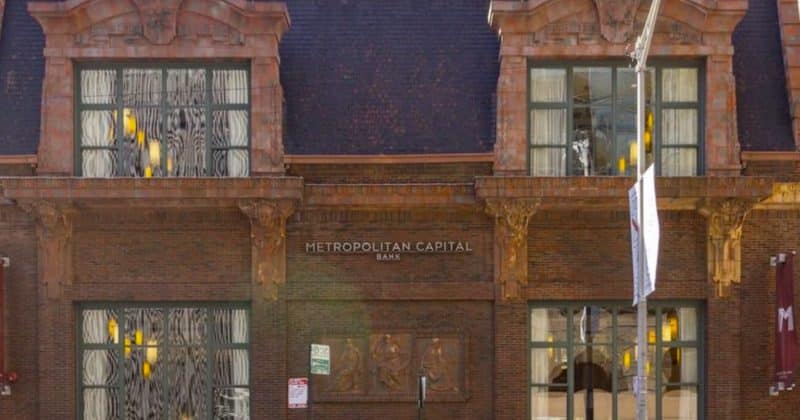

The Federal Deposit Insurance Corp. (FDIC) said Metropolitan Capital Bank & Trust, a Chicago-based single-branch lender, became the first US bank to fail this year after regulators shut it down on Friday and appointed the FDIC as receiver. First Independence Bank will assume substantially all deposits of the failed Metropolitan Capital Bank & Trust and acquire about $251 million in assets. The former Metropolitan Capital branch will reopen on February 2 as a First Independence Bank location. Customers retain FDIC coverage automatically and can access funds immediately via checks, debit…

Tag: Bank

Nubank Wins Conditional Approval for US National Bank Charter

Nubank has received conditional approval from the US Office of the Comptroller of the Currency (OCC) to form a national bank, a step that allows the fintech to offer deposits, lending, credit cards and digital asset custody in the United States. The approval moves Nubank into the bank organization phase, during which it must meet capitalization and supervisory conditions and secure additional approvals from the Federal Deposit Insurance Corporation and the Federal Reserve before launching operations. According to a company announcement on Friday, the US bank will be led by…

Brazil’s Nubank gets conditional approval to establish US national bank

Nu, Brazil’s largest digital bank, has obtained conditional approval from the Office of the Comptroller of the Currency (OCC) to establish a US national trust bank, Nubank, N.A., according to a recent announcement. Conditional OCC approval lets Nu enter the organization phase to build Nubank, N.A., but operations can’t start until satisfying OCC conditions, FDIC deposit insurance approval, and Federal Reserve clearance. Regulators mandate full capitalization within 12 months and bank opening within 18 months. Nu said in a statement that full approval of the charter would allow the bank…

Bank of England to prioritize systemic stablecoins and tokenised collateral policy in 2026

The Bank of England will focus on advancing a systemic stablecoins regime, setting out policy clarity on tokenised collateral under UK EMIR, and broadening the scope of the Digital Securities Sandbox in 2026, according to Sasha Mills, the bank’s Executive Director for Financial Market Infrastructure. Speaking at the Tokenisation Summit, Mills said the coming year would be “fundamental in shaping the UK’s digital financial future.” “We have the opportunity to build truly holistic digital financial markets in the UK, bringing real benefits to the real economy,” Mills said. Under the…

Bybit Launches Retail Bank Accounts With Personal IBANs

Bybit, one of the world’s biggest crypto exchanges by trading volume, plans to launch retail banking services on its platform starting in February, the company said Thursday. Bybit unveiled the product, “My Bank powered by Bybit,” during a live online keynote on Thursday. Bybit CEO Ben Zhou said the service will offer users a personal IBAN (international bank account number), allowing them to send and receive funds across banks in multiple currencies, with US dollar transfers supported at launch. The move marks Bybit’s latest effort to expand beyond crypto trading,…

Fidelity to Launch Stablecoin Through National Trust Bank

Fidelity Investments plans to launch a new stablecoin next month, marking a logical next step for the asset manager as it expands its digital-asset infrastructure following conditional approval for a national trust bank from the Office of the Comptroller of the Currency. Bloomberg reported Wednesday that the Fidelity Digital Dollar, or FIDD, will be issued by Fidelity Digital Assets, National Association, the national trust bank approved by US regulators in December. Fidelity Digital Assets president Mike O’Reilly told the publication that stablecoins could “serve as foundational payment and settlement services,”…

Banks Fear Stablecoin “Bank Run”, Regulators See No Impact

Banks warn stablecoins — especially those paying yield — could pull deposits out of the banking system, but policy and finance experts say there’s little evidence of that so far. Major US bank Standard Chartered recently estimated in a research note that stablecoin growth could drain bank deposits. The report estimates “that US bank deposits will decrease by one-third of stablecoin market cap,” which currently stands at $308.15 billion according to DeFiLlama data. The debate has intensified as US lawmakers weigh whether to prohibit interest on stablecoin holdings under a…

Laser Digital seeks US bank charter amid regulatory thaw under Trump-era OCC

Laser Digital, Nomura’s crypto arm, has applied for a national trust bank charter with the US OCC to launch federally regulated crypto custody and spot trading services, according to a Financial Times report. The move would allow the firm to bypass state-level licenses and operate under a unified federal framework. The application joins a wave of OCC charter filings as crypto and fintech firms pursue access to traditional banking infrastructure. Fourteen such applications were filed in 2025, nearly matching the total from the previous four years. The surge reflects a…

Nomura-Backed Laser Digital Reportedly Applies for US Bank Charter

Laser Digital, a full-service digital asset company backed by Japanese financial group Nomura, has reportedly filed for a US national bank trust charter, signaling that crypto-focused companies are seeking deeper integration into the US financial system amid a more permissive regulatory environment. Citing sources familiar with the matter, the Financial Times reported Tuesday that Laser Digital had submitted its application to the Office of the Comptroller of the Currency (OCC). The charter would allow the company to operate at the federal level without applying for state-by-state custody licenses. The company…

Stablecoins Threaten Bank Deposits, Standard Chartered Warns

Stablecoins pose a real risk to bank deposits both globally and in the United States, according to a new report by Standard Chartered analysts. The delay of the US CLARITY Act — a bill proposing to prohibit interest on stablecoin holdings — is a “reminder that stablecoins pose a risk to banks,” Geoff Kendrick, global head of digital assets research at Standard Chartered, said in a report on Tuesday seen by Cointelegraph. “We estimate that US bank deposits will decrease by one-third of stablecoin market cap,” the analyst said, referring…