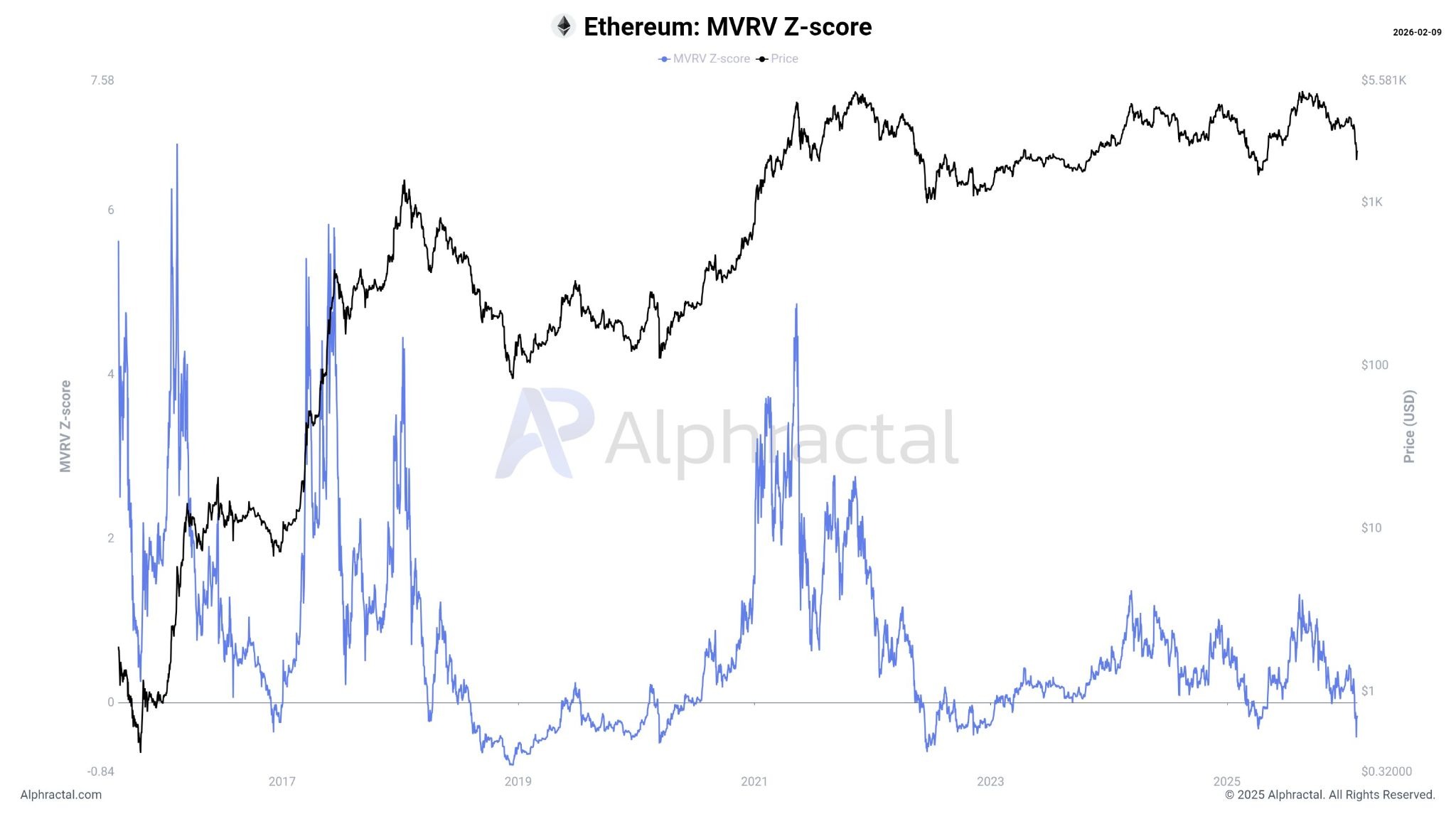

Ethereum has hit a zone typically associated with mass selling, with an MVRV Z-Score returning a score of -0.42 — though analysts are split on whether the price of Ether is close to bottoming out.

The MVRV Z-Score is a metric used to assess whether a crypto asset is overvalued or undervalued by comparing its market value to its realized value, which reflects the total value of Ether based on the price at which it was last transacted.

The metric was created to show periods of market euphoria or capitulation when the market value was considerably higher or lower than the realized value.

CryptoQuant analyst and Alphractal founder and CEO, Joao Wedson, said the score “shows that Ethereum is indeed going through a clear capitulation process.”

However, the analyst said the data “does not compare to the intensity” seen at the major bottoms of the 2018 and 2022 bear markets.

The lowest value in history was -0.76, recorded in December 2018, said Wedson.

Further downsides for ETH prices possible

The analyst cautioned that further downsides could be possible before any meaningful recovery.

“The market is already under stress, but historically, there is still room for further downside before a definitive structural bottom is formed,” he said.

The price of Ether has fallen 30% over the past fortnight, reaching a bear market low of $1,825 on Friday before a minor recovery to $2,100 on Monday.

Related: Tom Lee tips lack of leverage and gold ‘vortex’ for Ether’s 21% slump

HashKey Group senior researcher Tim Sun told Cointelegraph that historically, Ethereum’s MVRV Z-Score “has proven to be a highly reliable indicator for tracking subsequent market shifts, particularly in identifying bottoming zones across multiple cycles.”

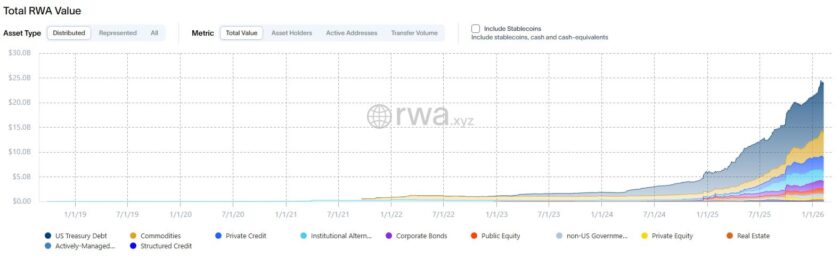

“Judging by on-chain activity, protocol evolution, and long-term ecosystem structure, Ethereum’s fundamentals have not seen any substantive deterioration. On the contrary, they continue to improve across several key dimensions,” he said.

However, it is premature to conclude that Ether has finished its bottoming process as long as the primary drivers of the current decline persist, he added.

“Given the potential liquidity constraints associated with the upcoming April tax season, the probability of further price downside remains a significant factor.”

One of the best “buy fear” windows for Ether

Other market commentators, such as MN Fund founder Michaël van de Poppe, were a little more optimistic, stating, “I think that this is a tremendous opportunity to be looking at ETH.”

“The core reason for this is that there’s a massive gap to the ‘fair price,’” he said, referring to the MVRV ratio.

Ether is currently as undervalued as it was during the April 2025 crash, the June 2022 bottom after the Terra/Luna collapse, the March 2020 Covid crash, and the December 2018 bear market bottom.

“In all of those cases, this provided a tremendous buying opportunity for this particular asset.”

Andri Fauzan Adziima, research lead at crypto trading platform Bitrue, told Cointelegraph that negative MVRV zones “have repeatedly preceded explosive recoveries in past cycles.”

“With ETH’s network metrics holding strong, it feels like a prime long-term accumulation setup once the weak hands are fully flushed,” he said.

“Brutal capitulation now, but historically one of the best ‘buy fear’ windows for ETH.”

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest