Bitcoin has fallen to the 12th-largest asset globally by market capitalization, slipping behind Tesla in the rankings, according to CompaniesMarketCap. The digital asset’s price tumbled to $81,000 earlier today and continued to fall as trading progressed. At the time of writing, BTC was hovering around $77,300, down 8% over the past 24 hours, TradingView data shows. The recent decline has pushed Bitcoin’s market capitalization down to approximately $1.5 trillion, allowing Tesla, now valued at $1.6 trillion, to move ahead to the 11th position. Earlier this week, Bitcoin fell out of…

Month: January 2026

Chicago-based Metropolitan Capital Bank becomes first bank to fail in 2026

The Federal Deposit Insurance Corp. (FDIC) said Metropolitan Capital Bank & Trust, a Chicago-based single-branch lender, became the first US bank to fail this year after regulators shut it down on Friday and appointed the FDIC as receiver. First Independence Bank will assume substantially all deposits of the failed Metropolitan Capital Bank & Trust and acquire about $251 million in assets. The former Metropolitan Capital branch will reopen on February 2 as a First Independence Bank location. Customers retain FDIC coverage automatically and can access funds immediately via checks, debit…

Strategy’s BTC Holdings Flip Red as Bitcoin Crashes to as Low as $75,500

Bitcoin saw a sudden weekend liquidity cascade that took BTC price to near $75,000 for the first time since its April 2025 low. Bitcoin (BTC) fell over 7% during weekend trading as a fresh price collapse liquidated $800 million. Key points: Bitcoin drops to near its 2025 low as mass liquidations accelerate. BTC price action fails to hold $80,000 and its key true market mean level. Strategy’s 700,000 BTC corporate treasury falls into the red versus its aggregate cost basis. BTC price collapses below $76,000 Data from TradingView showed BTC…

BitMine Faces $6B Unrealized Ether Loss as Crypto Sell-Off Deepens

BitMine Immersion Technologies, a publicly traded cryptocurrency treasury company linked to investor Tom Lee, is carrying significant unrealized losses on its Ether holdings following the latest wave of market liquidations, underscoring the risks facing crypto balance-sheet strategies during sharp downturns. After acquiring an additional 40,302 Ether (ETH) last week and increasing its total holdings to more than 4.24 million ETH, BitMine’s unrealized losses have grown to over $6 billion, according to data from Dropstab, a platform that tracks digital asset prices and portfolio valuations. Based on current market prices, BitMine’s…

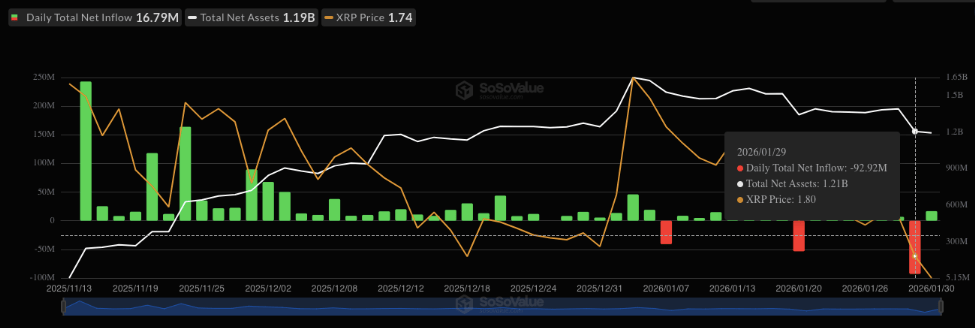

XRP ETFs Set New Record

Despite a major outflow just a day earlier, Spot XRP ETFs have defied bearish sentiment, setting record trading volumes and attracting fresh inflows. This resilience and surge in investor demand is particularly surprising given the recent crash in the XRP price and the overall downturn in the broader crypto market. Related Reading XRP ETFs Defy Trends And Hit Record Volume XRP is making headlines after its ETF experienced fresh inflows following a significant outflow. According to data from SoSoValue, XRP ETFs saw a record $92.9 million drop on January 29,…

How CoreWeave and Miners Pivoted

CoreWeave’s transformation from a crypto-mining operator to a large-scale AI infrastructure provider highlights a broader shift in how computing resources are reused across technology cycles. In its latest newsletter, The Miner Mag outlined how Ethereum’s move away from proof-of-work reduced demand for GPU-based mining, pushing companies like CoreWeave to redeploy hardware toward AI training and other high-performance computing workloads as demand for compute began to rise. As Cointelegraph previously reported, CoreWeave began moving away from crypto mining as early as 2019, shifting first into cloud and high-performance computing before fully…

IPOs, Venture Rounds and On-Chain Credit

Venture capital and institutional money are flowing back into digital asset companies at the start of 2026, with industry data showing $1.4 billion committed across venture rounds and public market listings. The largest transactions included Visa-linked stablecoin issuer Rain, which reached a $1.9 billion valuation after raising $250 million, and crypto custodian BitGo’s $200 million-plus IPO on the New York Stock Exchange in January. While crypto markets remain under pressure following October’s broad-based liquidation that wiped out billions in leveraged positions across centralized and decentralized markets, institutional engagement in the…

Bitcoin drops to $81K, wiping out over $380M in longs as US government enters partial shutdown

Bitcoin slipped below $81,000 on Saturday morning, pushing weekly losses to 9% amid continued market volatility. Over $380 million in long positions were liquidated in the past hour following the sudden drop, according to CoinGlass. The leading crypto asset was trading at around $80,900 at press time, down 3% in the last 24 hours, CoinGecko data shows. Macroeconomic headwinds continue to weigh on crypto markets. A partial government shutdown, which began over the weekend, has heightened market tensions as lawmakers await a Monday vote, while a new 50% tariff on…

‘Better Opportunity to Buy’ BTC Than 2017

Bitcoin (BTC) fell to a record low versus gold (XAU) in January, making it a better buying opportunity than what preceded the 2015–2017 bull market, analysts say. Key takeaways: BTC vs gold hit a record low, a level that has lined up with past major bottoms. Some analysts warn that a rotation to BTC from gold is not guaranteed. Gold-to-Bitcoin rotation could start in February On Saturday, Bitcoin’s value compared to gold fell to its lowest level ever after adjusting for the global money supply, data from Bitwise Europe showed.…

TD Sequential Flashes Buy Signal For XRP On Key Price Condition

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency. Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems. In two years of active…