DWF Labs, a cryptocurrency-focused market maker, has expanded into physical commodities after settling its first physical gold transaction, a rare move for a crypto-native company as precious metal prices continue to break record highs. On Monday, managing partner Andrei Grachev said DWF Labs had “just settled our first gold trade,” describing it as a test tranche involving a single 25-kilogram gold bar. Grachev said the company plans to scale the operation, with ambitions to trade physical silver, platinum and cotton. Notably, the transaction was completed using conventional bullion custody and…

Day: December 23, 2025

Silver hits record high above $71 as market cap approaches $4 trillion

Key Takeaways Silver is up 138% in 2025, surpassing gold and becoming the fourth largest asset by market cap. Precious metals are benefiting from a weaker dollar, rate cut expectations, and rising demand for risk hedges. Share this article Silver rose above the $71 mark on Tuesday midday, setting a new all-time high as it extends a powerful rally that has made it one of 2025’s top-performing assets. The metal is now up roughly 138% year-to-date, outperforming gold’s 70% gain and matching the returns of platinum. With a market capitalization…

Upcoming US Crypto Legislation and Policies to Watch in 2026

Many crypto industry leaders and users anticipate significant changes in the US regulatory environment over the next 12 months, as various policy changes and legislation begin to take effect. Although the inauguration of US President Donald Trump in January 2025 did not mean an immediate end to all digital asset regulation, many of the administration’s policies, from dismissing enforcement cases of crypto companies by the Securities and Exchange Commission to signing a stablecoin bill into law, signal apparent differences to previous US presidents and their chosen regulators. “I expect an…

IMF confirms El Salvador Government will Sell Chivo Bitcoin Wallet

The International Monetary Fund’s mission chief for El Salvador issued a statement confirming that government authorities were proceeding with negotiations for the sale of the country’s Chivo Bitcoin wallet. In a Monday statement, the IMF said El Salvador’s government was continuing to discuss its Bitcoin (BTC) project with the fund’s officials, and “negotiations for the sale of the government e-wallet Chivo are well advanced.” The announcement signaled that the government may be preparing to sell some or all of its crypto holdings in the Chivo wallet. Source: IMF The statement…

Will Ethereum Finally Break Out or Crash to $2,400?

Ethereum trades near $3,100 resistance as accumulation builds, with charts showing upside toward $4,100 while short-term patterns warn of downside risk. Ethereum is trading just below a key price level watched across the market. The $3,100 area has capped price moves for several years, and recent trading has brought ETH back near that zone. The asset is priced at around $2,950 at press time, down 3% over the past 24 hours and up almost 1% over the last seven days. Daily trading volume is close to $22.6 billion. Ethereum…

Circle announces €300M circulation of MiCA-compliant EURC stablecoin

Key Takeaways Circle reports €300M in EURC circulation as demand for trusted euro stablecoins grows. Circle positions EURC as a MiCA-compliant, fully reserved euro stablecoin for real-time payments and global use. Share this article Circle’s EURC stablecoin has reached €300 million in circulation, the company announced today via its official X account. The milestone reflects growing demand for MiCA-compliant, fully reserved euro stablecoins that can be used globally. Circle highlighted the role of stablecoins in the digital economy, stating: “From real-time settlement to global commerce, stablecoins are becoming a core…

Bybit rolls out new insurance fund mechanism for USDT perpetual contracts

Key Takeaways Bybit has introduced specialized insurance fund pools to enhance loss-absorption and reduce unnecessary Auto-Deleveraging in USDT perpetual contracts. The new structure increases loss coverage per contract by over 200% and features automated thresholds and real-time monitoring. Share this article Bybit is upgrading its insurance fund system to reduce the frequency of Auto-Deleveraging events and offer stronger protection during high volatility, according to a Tuesday announcement. The new mechanism introduces two specialized Insurance Fund Pools: the New Listing Insurance Fund Pool, which covers the first 30 days of new…

Glassnode reports persistent negative net flows in US Bitcoin and Ethereum ETFs

Key Takeaways Bitcoin and Ethereum ETF flows have remained negative since early November. Glassnode attributes trend to reduced institutional participation and market-wide liquidity contraction. Share this article US Bitcoin and Ethereum ETF net flows have remained negative since early November, according to blockchain analytics firm Glassnode. The 30-day simple moving average for both asset classes turned negative in early November and has stayed below zero. Glassnode attributed the trend to “a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market.”…

BitGo launches Aptos staking for institutional clients

Key Takeaways BitGo has introduced Aptos staking services specifically for institutional clients. Clients can stake APT tokens and earn rewards while using BitGo’s secure custody platform. Share this article BitGo has launched Aptos staking services for institutional clients, the company announced today. Institutions can now stake APT directly through BitGo’s custody and wallet infrastructure. The service enables clients to earn staking rewards while maintaining assets under BitGo’s security framework. Aptos is a layer 1 blockchain network, and APT is its native token used for staking and network operations. Source link

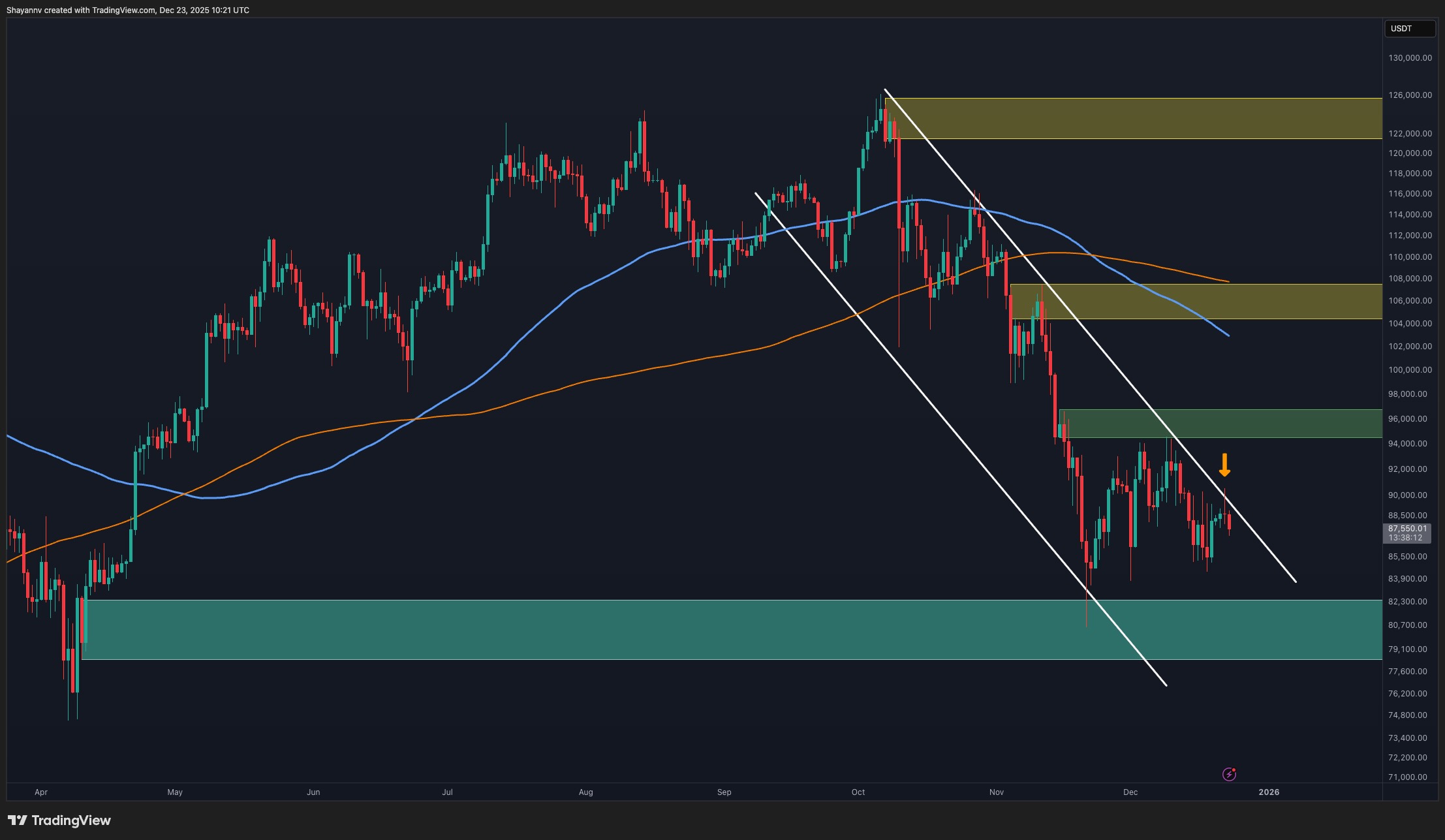

What’s the Most Likely BTC Scenario Over Christmas?

Bitcoin remains under short-term pressure as the price continues to consolidate below key resistance levels. While volatility has compressed, multiple technical and on-chain signals suggest the market is approaching a decisive phase. Technical Analysis By Shayan The Daily Chart On the daily timeframe, BTC has recently experienced a rejection at its major descending trendline that has consistently acted as dynamic resistance during recent attempts to recover. Each rally into this trendline has been met with selling pressure, reinforcing its technical significance. At the same time, Bitcoin is holding above a…