Gas fees on the Ethereum layer-1 blockchain dropped to just 0.067 Gwei on Sunday, amid a lull in the crypto markets sparked by October’s historic market crash. The average price for executing a swap on Ethereum is just $0.11, non-fungible token (NFT) sales carry a fee of $0.19, bridging a digital asset to another blockchain network will cost users $0.04, and onchain borrowing costs $0.09 at the time of this writing, according to Etherscan. Ethereum network transaction fees hit a recent high of 15.9 Gwei on October 10, the day…

Day: November 9, 2025

Crypto Derivatives Market Cautiously Regains Stability After October’s Deleveraging Event: Bybit Report

While the crypto derivatives market shows signs of stabilizing after October’s liquidation, Bitcoin’s slide below $99,000 suggests traders remain cautious and the recovery fragile. It has been almost a month since the crypto market experienced one of its largest liquidation events in history, but the effects of that incident still linger. A joint crypto derivatives report from the crypto exchange Bybit and the investment research institute Block Scholes has revealed that traders are cautiously finding stability. This defensive stance has spread across the derivatives market, affecting both crypto options…

Current Crypto Market Price Action Similar to Early 2000s Stocks — Analyst

Crypto whales and long-term holders are cashing out, exerting constant selling pressure on markets, and keeping crypto prices suppressed, similar to market dynamics following the 2000s dot-com stock market crash, according to analyst Jordi Visser. Visser said the current price action in the crypto market is reminiscent of the period following the 2000 dot-com stock market bubble, which crashed stocks by up to 80%, followed by 16 years of consolidation before they regained their previous highs. This meant that venture capitalists, who invested in tech during the crash, were forced…

Digital Asset Treasury Companies Pour $42.7B Into Crypto in 2025, $22.6B Spent in Q3 Alone

BitMine Immersion, Sharplink, and Forward Industries are the only altcoin-focused DATCos among the top 15 holdings. Digital Asset Treasury Companies (DATCos) have deployed at least $42.7 billion in crypto acquisitions so far in 2025. Interestingly, more than half of that amount was spent in the third quarter alone, when DATCos collectively acquired $22.6 billion worth of digital assets. Q3 2025 has therefore been the strongest quarter on record for DATCo accumulation. Bitcoin DATCos Dominate In its latest analysis, CoinShares revealed that altcoin-focused DATCos represented $10.8 billion of this Q3…

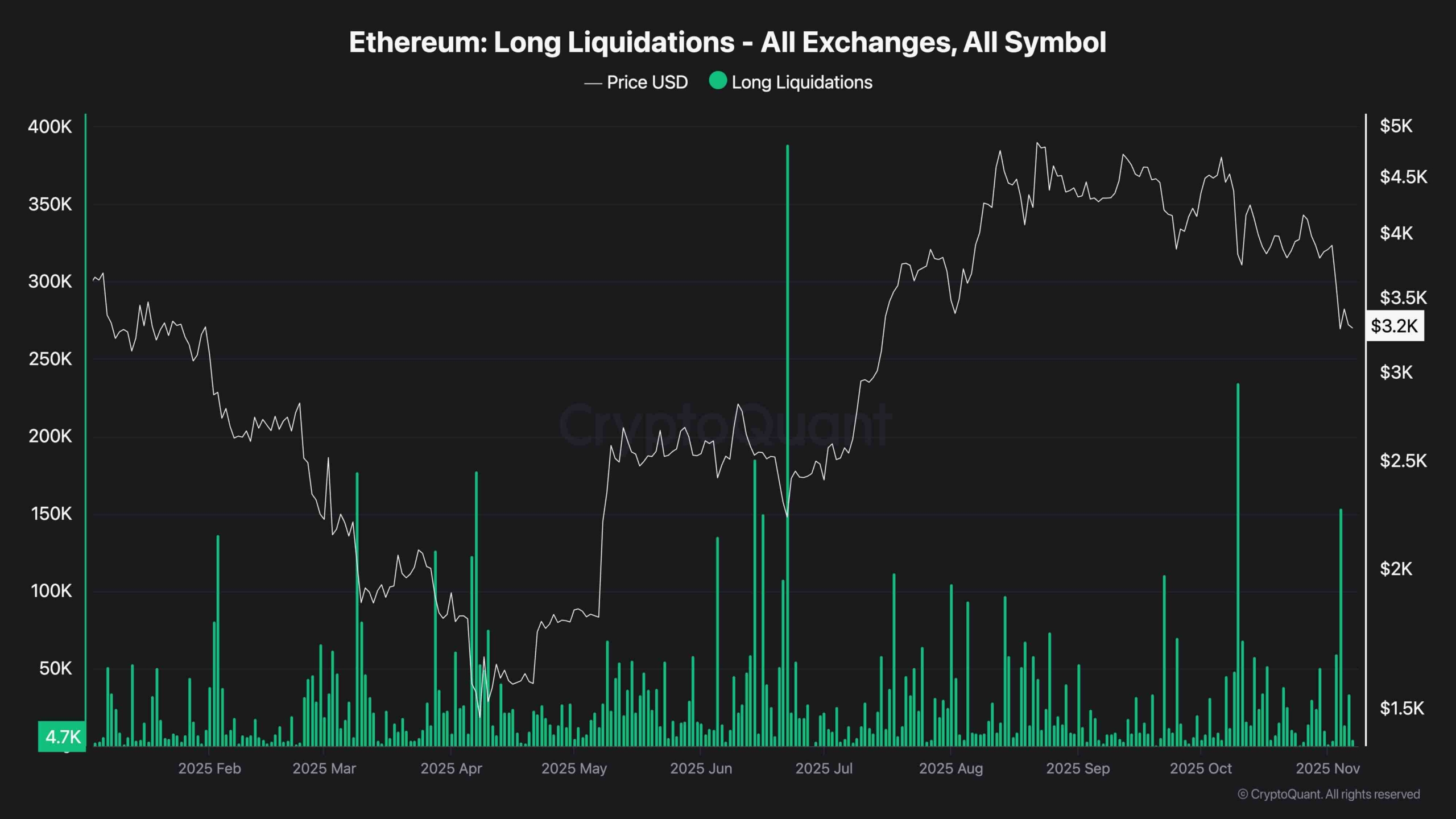

Will $3K Hold as ETH’s Bearish Momentum Intensifies?

Ethereum has slipped below the $3,300 mark, indicating persistent selling pressure in this zone. While bears aren’t showing strong momentum just yet, the fact that the price declined following a major liquidation event, one that already cleared out many over-leveraged longs, raises the risk of further downside. This hints that spot sellers could now be in control, opening the door for a deeper short-term correction. Technical Analysis By Shayan The Daily Chart On the daily chart, ETH dropped below the channel and has fallen slightly beneath the 200-day moving average.…

Robert Kiyosaki Sets Huge BTC, ETH Price Targets After Warning of an Impending Crash

Here’s what Kiyosaki is buying and selling as he prepares for a big market crash. The author of the bestseller Rich Dad, Poor Dad is back with his prognosis of a major market crash affecting numerous financial fields. Consequently, he outlined his strategy that involves purchasing certain assets and disposing of others. Additionally, Kiyosaki set some big price targets for his two favorite cryptocurrencies, which are also the two largest by market cap. Gold, Silver First The prominent author and investor has been advocating for BTC for years, but…

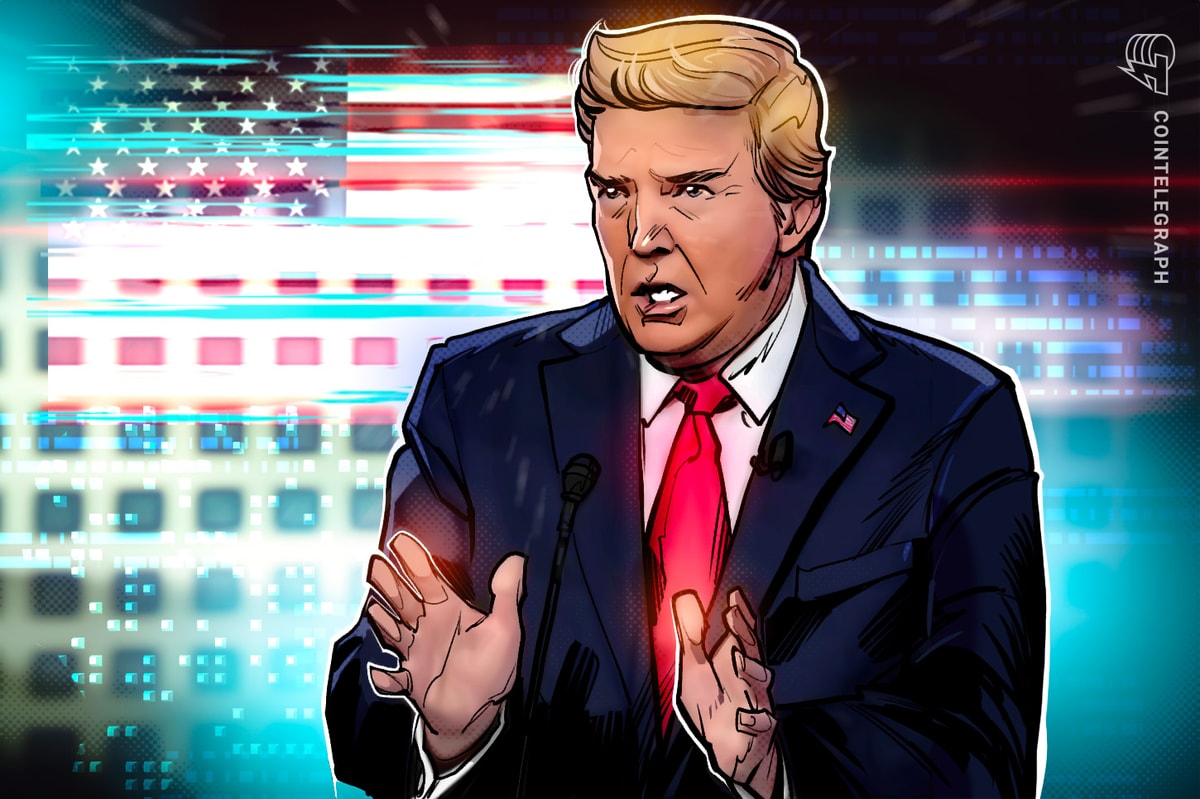

Trump Announces $2K Tariff Dividend for Most Americans

United States President Donald Trump announced on Sunday that most Americans will receive a $2,000 “dividend” from the tariff revenue and criticized the opposition to his sweeping tariff policies. “A dividend of at least $2000 a person, not including high-income people, will be paid to everyone,” Trump said on Truth Social. The US Supreme Court is currently hearing arguments about the legality of the tariffs, with the overwhelming majority of prediction market traders betting against a court approval. Source: Donald Trump Kalshi traders place the odds of the Supreme Court…

What BTC Must Do to Regain Bullish Momentum

Bitcoin continues to consolidate just above the $100K mark after experiencing a sharp rejection from the $116K resistance. While volatility has cooled down, the structure is showing signs of potential weakness. Buyers have yet to show strong signs of re-entry, and with the recent flush in open interest, the market remains cautious. Technical Analysis By Shayan The Daily Chart On the daily timeframe, BTC has broken below both the 100-day and 200-day moving averages, located around the $110K mark, indicating that short-term momentum has shifted bearish. The price is currently…

Bitcoin Price Spikes as Trump Announces $2,000 in Dividends to Some Americans

BTC rose to almost $104,000 minutes ago. Bitcoin’s price experienced another uptick in the past few hours as the asset tapped $104,000 for the third time in the past week. This one came after a rather interesting promise by US President Donald Trump, who said that many Americans, aside from high-income people, would get a dividend of at least $2,000 per person. BREAKING: President Trump announces that he will be paying a “tariff dividend” of at least $2,000 per person. Stimulus checks are officially back. pic.twitter.com/Dt4UgHVMrT — The Kobeissi…

The impossibility of perfect fairness in transaction ordering

For decades, research in distributed systems, especially in Byzantine consensus and state machine replication (SMR), has focused on two main goals: consistency and liveness. Consistency means all nodes agree on the same sequence of transactions, while liveness ensures the system continues to add new ones. Still, these properties do not stop bad actors from changing the order of transactions after they are received. In public blockchains, that gap in traditional consensus guarantees has become a serious problem. Validators, block builders or sequencers can exploit their privileged role in block ordering…