Share this article

A new generation of stablecoins is transforming how users earn yield: they offer both stability and income through advanced on-chain strategies, ultimately passing earnings to holders. This article reviews five of the leading yield-generating protocols of 2025: each offers a stable token targeting a $1 peg while offering varying levels of annual yield through distinct mechanisms.

1. Falcon Finance (USDf)

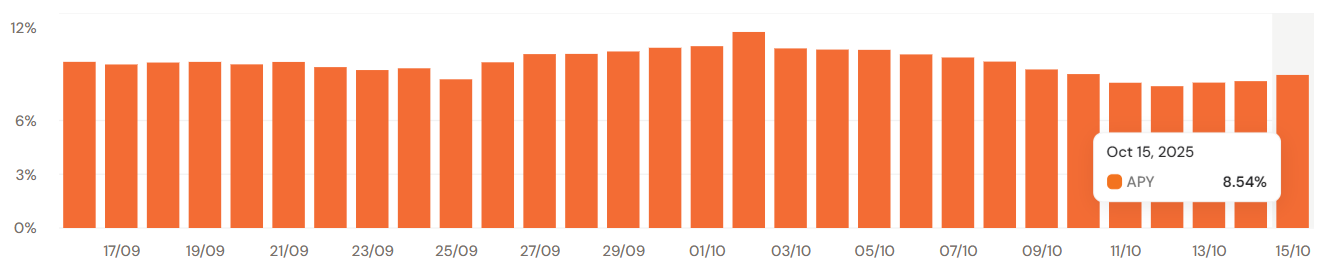

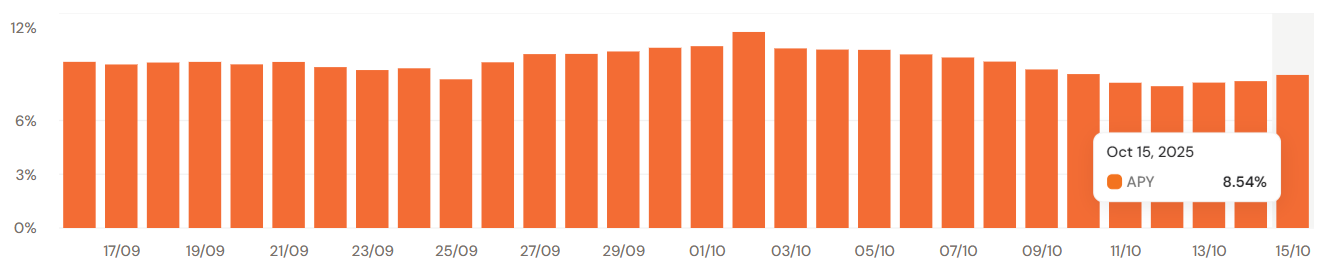

Falcon Finance issues USDf, a synthetic dollar backed by both crypto and tokenized RWAs. Its model combines over-collateralization with active yield generation across several markets. Users mint USDf by depositing diverse collateral, and can stake USDf with a 8-12% APY (yield rate can be boosted for locking for a fixed term). Yields come from a blend of delta-neutral arbitrage, staking rewards, and fixed-income returns from the U.S. Treasuries.

Why It Stands Out

What distinguishes Falcon Finance is a diversified, multi-strategy architecture, rather than depending on any single yield source. This enables USDf to maintain competitive yields while preserving its peg as a stable crypto. Over time, Falcon aims to evolve into a universal collateralization layer for the digital economy.

Growth

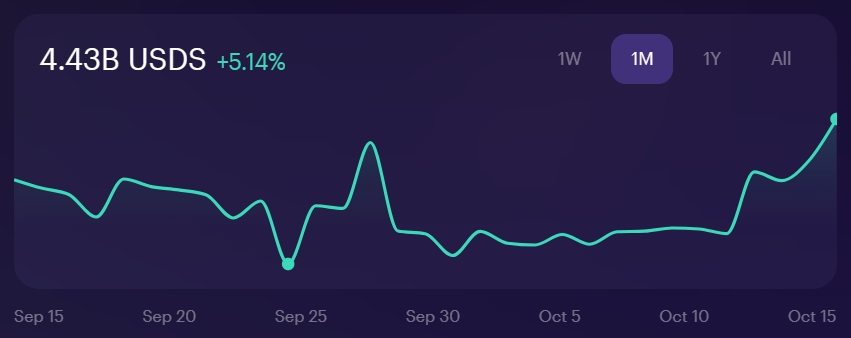

In the end of September 2025, Falcon launched its own governance token, FF. It was followed by a successful $10 million investment round in early October, and the 2nd season of the reward campaign. As a result, by October 2025, USDf supply surpassed $2 billion, marking a strong debut that underscores demand for hybrid yield models.

2. Ethena (USDe)

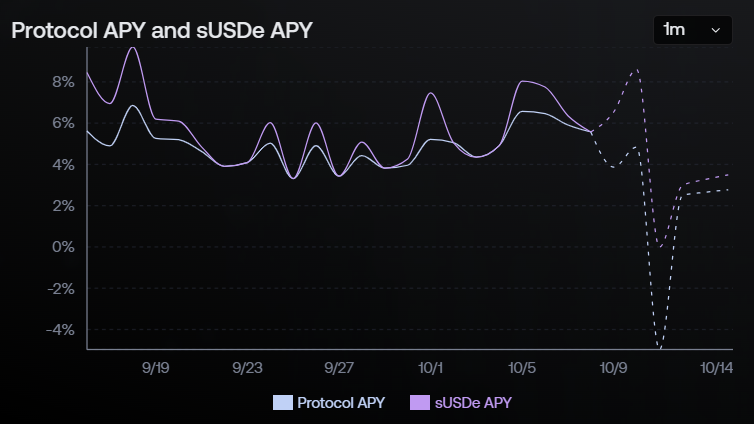

Ethena launched USDe in 2024, introducing a fully crypto-native approach to stable yield. Users mint USDe by locking crypto like ETH or stETH. Its key feature is delta-neutral positioning: the protocol balances spot and futures markets to stay pegged to the dollar while generating yield. Holders can stake into sUSDe, earning 4-8% APY from perpetual swap funding rates and staking rewards.

Why It Stands Out

Ethena was the first decentralized stablecoin-like protocol to deliver consistent yield and dollar stability without holding fiat or off-chain assets. Its on-chain transparency and minimal reliance on banks appeal to DeFi purists.

Growth

As crypto markets recovered in 2024 and 2025, Ethena’s model proved compelling: USDe circulation surged past $12 billion by mid-October 2025. However, returns remain sensitive to crypto market activity, strong in bull runs, weaker in flat markets.

3. Sky (USDS)

The Sky Protocol rebranded from MakerDAO and introduced its stablecoins, USDS, that generates yield. Users earn around 4.5% APY by depositing USDS. Much of the backing comes from tokenized Treasuries and corporate bonds, providing steady real-world returns. Governance adjusts the APY based on macro interest rates and vault activity.

Why It Stands Out

USDS is still a decentralized stablecoin project, but now deeply integrated with real-world yield. It combines trust, institutional collateral, and a revamped governance system under the SKY token.

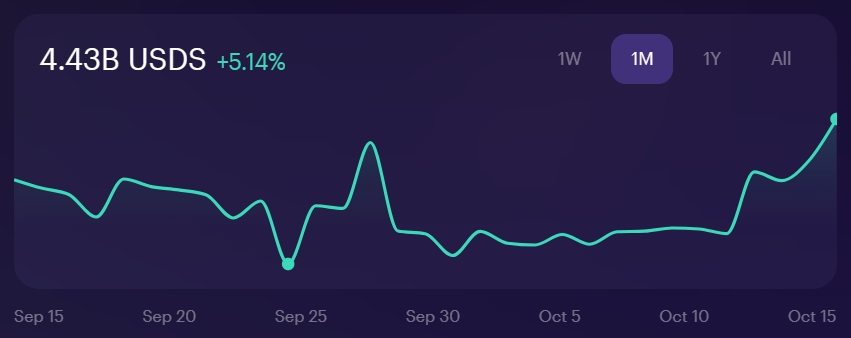

Growth

At launch, most DAI holders migrated to USDS, instantly creating billions in supply. By October 2025, USDS circulation exceeded $8 billion.

4. Ondo (USDY)

Ondo Finance offers USDY, a tokenized note representing short-term Treasuries and bank deposits. Unlike crypto-based models, USDY functions more like a money-market fund on-chain, providing stable returns without market exposure. USDY holders earn 4.1-4.5% APY, net of fees, fully backed by cash-equivalent assets.

Why It Stands Out

Ondo focuses on regulatory compliance and institutional access, making USDY one of the few stablecoins suitable for regulated entities. The downside is restricted access for US investors, but its transparent, asset-backed model positions it as a secure yield vehicle.

Growth

Ondo has formed major partnerships with blockchain ecosystems like Mantle and various funds. Despite investor restrictions, USDY circulation reached about $700 million by October 2025.

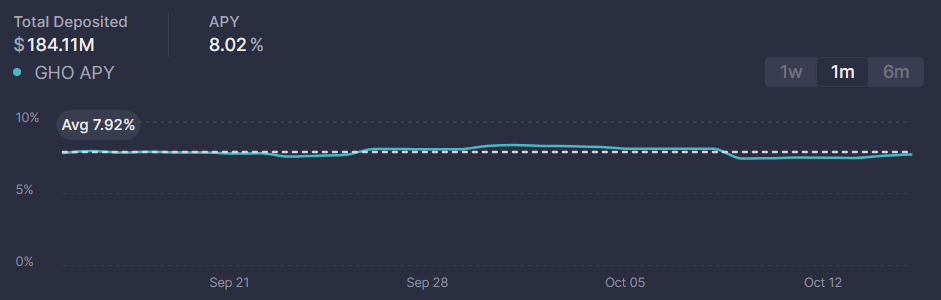

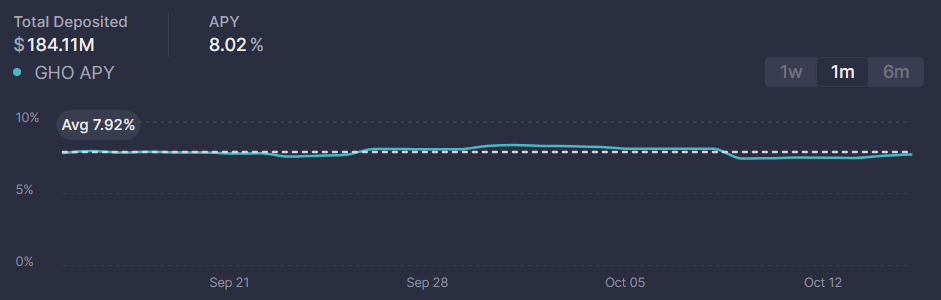

5. Aave (GHO)

Aave’s GHO stablecoin debuted in 2023 and gradually evolved into a central piece of the Aave ecosystem. Like USDf and USDS , it’s over-collateralized, but introduces extra features such as discounted borrowing for AAVE stakers and an integrated Aave Savings Rate (ASR). GHO can earn roughly 8% APY from staking it. Returns are sourced from borrowing interest and DAO incentives.

Why It Stands Out

GHO benefits from Aave’s vast liquidity network and governance infrastructure, ensuring deep integration within DeFi lending markets. Its design leverages Aave’s scale instead of reinventing stablecoin mechanics, offering a straightforward but reliable yield option.

Growth

After a slow start, updates in 2024—including peg-stability modules and higher borrow rates—revived adoption. By mid-October 2025, GHO’s supply reached around $350 million, showing steady expansion.

Closing Thoughts

The surge of USDf, USDe, USDS, USDY, and GHO marks a pivotal evolution in crypto, where stablecoins no longer just store value but actively earn it. Each project takes a distinct path: from Ethena’s crypto-only strategy to Ondo’s regulated RWA yields. Among them, Falcon Finance emerges as the most ambitious, merging multiple yield engines under one roof.